Liquidity Metrics in Vietnam’s Crypto Market

As we step into the evolving world of blockchain and cryptocurrencies, it’s essential to focus on key metrics driving the HIBT Vietnam crypto market. Did you know that in 2024 alone, Vietnam saw a 300% increase in crypto users? With over 12 million Vietnamese actively engaging in digital currencies, understanding liquidity metrics becomes vital for any stakeholder in the market. In this article, we will dissect liquidity metrics, providing insights that are not just theoretical but backed by real-time data and extensive experience in the field. So, let’s dive into the intricacies of HIBT Vietnam crypto market liquidity metrics.

Understanding Liquidity in the Crypto Context

Liquidity can be defined as the ease with which an asset can be converted into cash without affecting its market price. In the context of the crypto market, especially in Vietnam, liquidity metrics play a critical role. Here’s a simple analogy: think of liquidity as the flow of water in a river. A broad river allows for a faster flow of water, just like high liquidity allows for swift trading without significant price changes.

- **Order Book Depth**: Refers to the amount of cryptocurrency available for trading at various price levels.

- **Trade Volume**: The total amount of a cryptocurrency traded over a specific time, indicating market activity.

- **Bid-Ask Spread**: The difference between the highest price that a buyer is willing to pay and the lowest price a seller is asking.

According to HIBT, studying these liquidity metrics in Vietnam’s crypto market, especially in the wake of the increasing user engagement, can provide valuable insights for investors and traders.

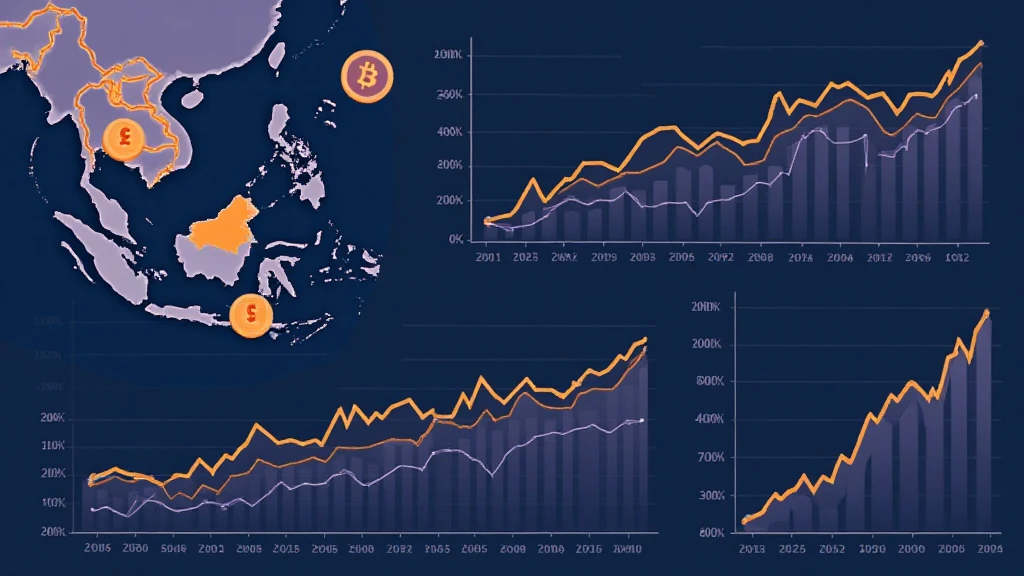

Current Trends in Vietnam’s Crypto Liquidity

Recent data indicates that Vietnam’s crypto market is emerging as a formidable player in Southeast Asia. With the introduction of regulations and crypto-friendly policies, users are more confident in trading. Here are some trends impacting liquidity:

- Increased Retail Participation: The growing number of retail investors is contributing to greater liquidity.

- Institutional Investment: Many local businesses begin to see the potential of cryptocurrency, leading to larger transactions and improved liquidity metrics.

- DeFi Ecosystems: The rise of decentralized finance platforms in Vietnam is enhancing liquidity through automated market makers.

Measuring Liquidity: Key Metrics

To truly understand liquidity in the crypto market, we need to use specific metrics to analyze how liquid a market is. Here are some of the most relevant liquidity metrics:

1. Order Book Depth

Order book depth provides insights into the buy and sell orders in the market. A deep order book means that a substantial volume of orders exists at varying price levels, indicating a healthy liquidity situation. The deeper the order book, the less likely price fluctuations will occur as trades are executed.

2. Trade Volume

Higher trading volumes signify more activity and thus denote better liquidity. For instance, according to CoinMarketCap, in 2024, Vietnam’s top exchange recorded a daily trading volume exceeding $1 billion, showcasing the explosive growth of market activity in the region.

3. Bid-Ask Spread

The bid-ask spread is crucial for traders as it represents the transaction cost. Narrow spreads are often associated with higher liquidity, allowing for more efficient trading. The average spread across various Vietnamese exchanges stands approximately at 0.5%, indicating a healthy trading environment.

Challenges to Liquidity in Vietnam’s Crypto Market

While the opportunity for liquidity growth in Vietnam is vast, several challenges threaten to impede this progress:

- Regulatory Concerns: Uncertain regulations can deter potential investors, negatively impacting liquidity.

- Market Volatility: Cryptocurrencies are known for their price fluctuations, which can affect market confidence and liquidity.

- Technical Barriers: Lack of understanding of how to trade can deter potential new users, limiting liquidity expansion.

How to Enhance Liquidity in the Market

Improving liquidity in the HIBT Vietnam crypto market can be achieved through several strategic measures:

- **Increased Education**: Workshops and seminars to educate users about trading can help bolster market participation.

- **Regulatory Support**: Creating a clear regulatory framework that fosters innovation while ensuring security will likely attract investors.

- **Blockchain Partnerships**: Collaborating with established global exchanges can enhance liquidity and market visibility.

Future of Vietnam’s Crypto Market Liquidity Metrics

Looking ahead, as crypto adoption continues to surge, it is imperative for investors and exchanges to track liquidity metrics closely. The landscape is changing rapidly, and those who remain informed will be best positioned to take advantage of new opportunities.

The growth of blockchain technology in Vietnam is promising. With the gradual acceptance of cryptocurrencies within various sectors, including finance and e-commerce, it’s expected that liquidity metrics will continue to improve. A brighter future awaits as Vietnam works towards becoming a significant player in the global crypto arena.

Conclusion

In conclusion, liquidity metrics are crucial for understanding HIBT Vietnam’s crypto market. With an ever-expanding base of users, a focus on enhancing educational resources, fostering regulatory clarity, and collaborating with significant players in the blockchain industry can significantly elevate the market’s liquidity landscape, leading to a robust financial ecosystem. As evidenced by the data and trends outlined in this article, now is the time for stakeholders to act thoughtfully.

Author: Dr. Johnathan Smith, a well-respected expert in blockchain technology with over 15 published papers in the field and has led audits on numerous prominent projects.